Participate

Your participation in building positive communities in your

Severity: 8192

Message: explode(): Passing null to parameter #2 ($string) of type string is deprecated

Filename: core/Router.php

Line Number: 417

Backtrace:

File: /home4/pardivs1/public_html/index.php

Line: 315

Function: require_once

Severity: Warning

Message: ini_set(): Session ini settings cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 282

Backtrace:

File: /home4/pardivs1/public_html/application/controllers/front/Front.php

Line: 16

Function: __construct

File: /home4/pardivs1/public_html/index.php

Line: 315

Function: require_once

Severity: Warning

Message: session_set_cookie_params(): Session cookie parameters cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 294

Backtrace:

File: /home4/pardivs1/public_html/application/controllers/front/Front.php

Line: 16

Function: __construct

File: /home4/pardivs1/public_html/index.php

Line: 315

Function: require_once

Severity: Warning

Message: ini_set(): Session ini settings cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 304

Backtrace:

File: /home4/pardivs1/public_html/application/controllers/front/Front.php

Line: 16

Function: __construct

File: /home4/pardivs1/public_html/index.php

Line: 315

Function: require_once

Severity: Warning

Message: ini_set(): Session ini settings cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 314

Backtrace:

File: /home4/pardivs1/public_html/application/controllers/front/Front.php

Line: 16

Function: __construct

File: /home4/pardivs1/public_html/index.php

Line: 315

Function: require_once

Severity: Warning

Message: ini_set(): Session ini settings cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 315

Backtrace:

File: /home4/pardivs1/public_html/application/controllers/front/Front.php

Line: 16

Function: __construct

File: /home4/pardivs1/public_html/index.php

Line: 315

Function: require_once

Severity: Warning

Message: ini_set(): Session ini settings cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 316

Backtrace:

File: /home4/pardivs1/public_html/application/controllers/front/Front.php

Line: 16

Function: __construct

File: /home4/pardivs1/public_html/index.php

Line: 315

Function: require_once

Severity: Warning

Message: ini_set(): Session ini settings cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 317

Backtrace:

File: /home4/pardivs1/public_html/application/controllers/front/Front.php

Line: 16

Function: __construct

File: /home4/pardivs1/public_html/index.php

Line: 315

Function: require_once

Severity: Warning

Message: ini_set(): Session ini settings cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 375

Backtrace:

File: /home4/pardivs1/public_html/application/controllers/front/Front.php

Line: 16

Function: __construct

File: /home4/pardivs1/public_html/index.php

Line: 315

Function: require_once

Severity: Warning

Message: session_set_save_handler(): Session save handler cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 110

Backtrace:

File: /home4/pardivs1/public_html/application/controllers/front/Front.php

Line: 16

Function: __construct

File: /home4/pardivs1/public_html/index.php

Line: 315

Function: require_once

Severity: Warning

Message: session_start(): Session cannot be started after headers have already been sent

Filename: Session/Session.php

Line Number: 143

Backtrace:

File: /home4/pardivs1/public_html/application/controllers/front/Front.php

Line: 16

Function: __construct

File: /home4/pardivs1/public_html/index.php

Line: 315

Function: require_once

Happy Years

We are a Non-Profit Organisation (NPO), registered on 13th January 2011 under the Andhra Pradesh Societies Registration Act of 35/2001, bearing Reg. No. 19/2011. Our services primarily center around empowering deprived children (V-kids), their families, and marginalized communities through Education, Health, Environment, Skill Development, and Livelihood interventions promoting inclusive and sustainable development at the grassroots. We are one of the best NGOs in India, dedicated to achieving the United Nations Sustainable Development Goals (SDGs) in rural areas.

A prosperous rural society built with positive communities for inclusive and sustainable development of everyone and every village at the grassroots.

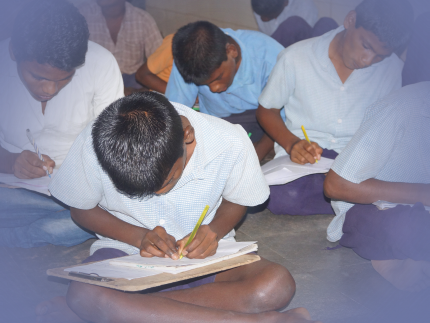

Empowerment of deprived children and their communities through education, health, environment, livelihood, and skill development interventions to build respect for their dignity, justice, and equity to improve the quality of life at the grassroots.

To provide 8.0 million e-hours of free education through the “After School Education Program” covering 20,000 V-kids in about 150 schools across rural India by 2030

To fetch 500,000 meals to the needy people in rural areas under the “Feed the Hungry” program by 2030

To give a life to 250,000 new trees under “Green Challenge” initiatives in both rural and urban areas by 2030

You could be our General Member by paying a nominal amount of Rs. 100.00 per...

Raised:₹300

Goal:₹10,000

“The POWER of ONE” represents the ability of an individual to effect change...

Raised:₹15,190

Goal:₹3,65,000

We cordially invite you to join us as “Lifetime Star Member” of PARD INDIA...

Raised:₹20,000

Goal:₹5,00,000

When everyone of us is living our life with full square meal, there are many destitute...

Raised:₹25,616

Goal:₹5,00,000

Our "V-kid Educational Fund" helps break the cycle of poverty and gives hope to the...

Raised:₹5,465

Goal:₹5,00,000

What is the “POWER of SEWING” to a poverty-ridden woman? It means that a woman...

Raised:₹0

Goal:₹12,00,000

Your participation in building positive communities in your

Your association as our partner is highly valued to bring a change

You can spread our social cause by representing us

We value our esteemed donors for their continued support

Beneficiaries

Children

Communities

Villages

Lives

Years

Be a part of a noble cause on your special occasions by

sharing your joy with the needy children and communities at grassroots

Madhuri aspires to become an Engineer and wants to change the plight of her family and village neighborhood with the help of PARD INDIA, one of the Popular NGOs in India. She hails from a remote village, Yadavolu, in East Godavari District, Andhra Pradesh, India, and is studying the 1st year of Intermediate in Zangareddigudam. Her parents are daily wage earners working in the fields in the village and supporting her studies to realize her dreams.

Read More