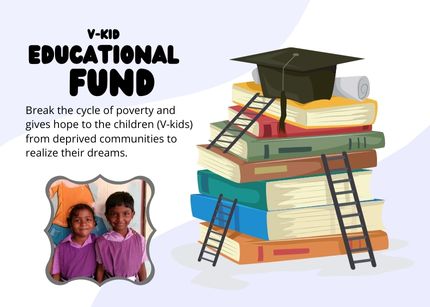

Save Tax & Secure the Future of a Child Donate to V-kid Educational Fund

Did you know your tax-saving investment can also secure the future of a child in need? Through PARD INDIA's V-kid Educational Fund, you can provide underprivileged children access to quality education while enjoying tax benefits under Section 80G.

Your contribution not only transforms young lives but also gives you a chance to save more. Let's build a brighter future-together!

Our "V-kid Educational Fund" helps break the cycle of poverty and gives hope to the children (V-kids are those children from a rural background, are often denied equal opportunities in their upbringing, study environment, and exposure to the competitive world) to realize their dreams. This fund can support implementing comprehensive and integrated educational programs that foster hope, good health, access to quality education, exposure to the competitive world, self-esteem, skill development, and, moreover, a high level of confidence among the V-kids.

- Empower Education: Your donation helps provide learning resources, school supplies, and tuition support to underprivileged children.

- Create Generational Impact: Empowering one child creates ripple effects across families and communities.

- Save More, Give More: With 80G tax exemptions, you can make a larger impact while reducing your taxable income.

By contributing to our V-Kid Educational Fund, you're not just donating-you're investing in the future of children from vulnerable communities in rural areas, ensuring they receive access to quality education and holistic development opportunities, by means of implementing the following programs under our READ Project:

Come, make a contribution today to reap dual benefits: the joy and satisfaction of changing a Child’s Life and the reward of Saving Tax.

"Because of V-kid Educational Fund, I can stay in school and dream of becoming a doctor. Thank you for giving me this chance!"

"Your support helped us rebuild our dreams. My son now has books, uniforms, and hope for the future."

Meera

ParentWhen one makes a donation, it makes you eligible to receive a donation exemption in income tax under 80G of the income tax regulation, which can significantly reduce your taxable income. This is especially beneficial during tax season when you're looking for ways to accommodate your finances. Here's how the 80G exemption works:

- Contributions made to registered Indian organizations like PARD INDIA qualify for the 50% income tax donation exemption. This way, your money goes towards significantly improving society by supporting programs like education for underprivileged children.

- By donating to PARD INDIA, you're not only helping to support future generations but also improving your cash in hand.

- To avail of the donation exemption in income tax, it's essential to provide your full name, complete address, and PAN number when making contribution. This information helps issue the 80G tax exemption certificate. This certificate is important for your records so that you can claim your tax benefits efficiently.

Donating to organisations like PARD INDIA is like investing in creating future for India's underprivileged children. Since 2011, PARD INDIA has positively impacted over 72,000 children over last 13 years, ensuring they have access to quality education and protection. Donating to these causes plays an important role in our mission, showcasing the power of collective effort in driving social change.

FREQUENTLY ASKED QUESTIONS

You can donate any amount. However, donations exceeding ₹500/- require additional details, including your PAN and Aadhaar number. Additionally, donations may qualify for 80G tax exemption, allowing you to claim tax benefits as per the Income Tax Act

Under 80G tax exemption of the Income Tax Act, donations can be either fully or partially exempted from taxes, depending on the organization’s eligibility.

Yes, it’s essential to retain the donation receipt for tax filing. The organization will provide you with a certificate confirming your contribution for claiming your donation exemption in income tax. This is vital for ensuring you can benefit from the tax exemption on donation, depending on the organization’s eligibility under the Income Tax Act.

No, to receive the donations tax exemption under 80G, you must provide your personal information, including your PAN, as mandated by tax regulations. This ensures compliance and helps the organization track donations effectively.

If you feel inspired to go beyond a donation, there are countless ways to get involved with PARD INDIA and make a lasting difference. Whether it’s mentoring a child, participating in awareness campaigns, or helping spread the word, your passion and skills can create a profound impact.

- Every little effort counts—by volunteering your time or expertise, you could play an essential role in driving change.

- Spread the Word: Share your commitment with friends, family, and on social media. By inspiring others to think about how they can help, you can create a ripple effect of kindness and support for the most vulnerable.

- Tax-Saving Benefits: Your donation also offers tax benefits under income tax rebates. Your generosity doesn’t just uplift lives but also helps you plan your finances better!

- Act Today, Build a Brighter Tomorrow

Every gift you make supports PARD INDIA’s mission to bring hope, education, and opportunities to innocent children. Let's build a community that supports and empowers the children from marginalized communities in rural areas. - Don’t wait—start your journey of making a difference today!

Terms and Conditions

Terms and Conditions

Pragathi Association for Rural Development, hereinafter referred to as PARD INDIA, takes your privacy seriously and treats all financial information about any transaction with PARD INDIA as highly confidential. In addition, PARD INDIA does not share e-mail addresses or phone numbers of any of our Donors or constituentswith any third party.

PARD INDIA profoundly values all contributions to sustain our mission and objectives. To protect the privacy of our Donors and their unique relationship with us, we maintain the following policies:

- We may request personal information online, such as name, address, phone number, email address, and credit card number ONLY to accept donations to PARD INDIA.

- We will not release or use this information for any other purpose unless you consent.

- We do not trade or sell your personal information with other organizations.

- We offer Donors the option to be recognized anonymously.

- Donors may request, at any time, not to receive our solicitations.

- Donors may request not to receive specific mailings, such as our newsletter.

- We do not track, collect or distribute personal information entered by those who visit our website.

- Personal data collected through our website is encrypted using 256-bit AES (Advanced Encryption Standard) technology.

- Personal information stored in the PARD INDIA database is protected with a secured login with authentication, assignment of a unique ID to each person with computer access, regular password changes, and user IDs are deactivated or terminated as needed. .

- Our hosting data server provides data protection meeting PCI DSS (Payment Card Industry Data Security Standard), encrypted communication via SSL (Secure Sockets Layer) technology.

To assure that philanthropy merits the respect and trust of the general public and that Donors and prospective Donors can have complete confidence in the not-for-profit organizations and causes they are asked to support, we assure the following:

- To be informed of PARD INDIA’s mission and purpose to use donations effectively for their intended purposes.

- Donations contributed will be used to meet the cost of projects & programs implemented by PARD INDIA.

- To be informed of the identity of those serving on the PARD INDIA’s governing body and to expect the body to exercise prudent judgment in its responsibilities.

- To have access to the organization’s most recent financial statements.

- To receive appropriate acknowledgment and recognition.

- To be assured that information about their donations is handled with respect and confidentiality to the extent provided by law.

- To expect all relationships with individuals representing the organization to the Donor will be professional.

- To be informed whether those seeking donations are members, volunteers, employees of the organization, or hired solicitors.

- To have the opportunity for their names to be deleted from mailing lists that the organization may intend to share.

- To feel free to ask questions when donating and to receive prompt, truthful, and forthright answers.

1. Refund of Donation Policy

PARD INDIA follows a reliable refund policy to let our Donors feel privileged about their association with us. We take utmost care about processing donations as per the mandates signed by our Donors in the Donor forms, both offline and online. But in case of an unlikely event of an erroneous deduction or if the Donor wants to cancel/deduct the donation, PARD INDIA will respond within 7 working days from the date of receiving the complaint from the Donor. The timely refund of the wrongly deduced amount will depend on the type of card used during the transaction. We would require proof of deduction of the donation amount and a written communication for a refund from the Donor within two days after the donation.

- In such cases, if the receipt has already been issued, then the Donor needs to return the original receipt to our official address.

- In the case of a tax exemption certificate already issued, a refund will not be possible.

- We can be contacted for refund requests by sending a request to info@pardindia.org

2. What Information We Collect

We use personal information collected from Donors to process payments, communicate with Donors about PARD INDIA, and conduct the fundraising and other operations of PARD INDIA. This information may include name, amount donated, address, telephone number, PAN Card Number, e-mail address, and any other personal information provided to us (“Donor Data”). Donor data also includes the data visible on the bank cheques for donations by cheque.

Information from Payment Processors and Other Service Providers: Payment processors allow Donors to give electronically using a payment services account, a credit card, or other payment method. These processors collect certain information from Donors, and you should consult their privacy policies to determine their practices.

To provide Donors with the best possible experience, we work with service providers and may share Donor Data and other information with them or transmit it through them. Such service providers include, for example, organizations that help non-profit organizations with fundraising.

3. How We Use That Information

Donor Data may be used for these kinds of purposes:

- Distributing receipts and thanking Donors for donations.

- Informing Donors about upcoming fundraising and other activities of PARD INDIA.

- Internal analysis, such as research and analytics.

- Record keeping.

- Reporting to applicable government agencies as required by law.

- Surveys, metrics, and other analytical purposes.

- Other purposes related to the fundraising operations.

Anonymous Donor information may be used for promotional and fundraising activities. Comments that are provided by Donors may be publicly published and may be used in promotional materials. We may use available information to supplement the Donor Data to improve the information we use to drive our fundraising efforts. We may allow Donors the option to have their name publicly associated with their donations unless otherwise requested as part of the online donation process.

We use data gathered for payment processors and other service providers only for the purposes described in this policy.

4. Contact Us

If you have questions about this Donor Privacy Policy or requests about the status and correctness of your Donor data, please get in touch with us:

Pragathi Association for Rural Development (PARD INDIA)

Ground Floor, Katari Kastle, Suryakantham Layout,

Goshala, Vepagunta Post,

Visakhapatnam, Andhra Pradesh. India, PIN: 530047.

Phone: (+91) 963-963-5858

Email: donorcare@pardindia.org

5. Security

We are committed to protecting Donor personal information from unauthorized access, alteration, disclosure, or destruction. Among other things, we undertake a range of security practices, including measures to help secure web access to sensitive data and undertake efforts to address security vulnerabilities for various tools and databases.

6. Other Disclosures

We may disclose information when required by law; when needed to protect our rights, privacy, safety, property, Donors, or users; and when necessary to enforce our terms of service.

7. Updates

We may change the Donor Privacy Policy from time to time. All changes will be reflected on this page. Substantive changes may also be announced through the standard mechanisms we communicate with our users and community. You should periodically check this page for any changes to the current policy.

8. Data Retention

We seek to retain Donor-related information only as needed to fulfill the purposes described in this policy unless a more extended retention period is required by law or regulations. For example, tax laws in India may require the organization to keep contact information and contribution level of Donors on file.

9. Rights of Donor

You have certain rights concerning the information we collect about you. Upon your request, we will tell you what information we hold about you and correct any incorrect information. We will also make reasonable efforts to delete your information if you ask us to unless we are otherwise required to keep it.

Privacy Policy

Privacy Policy

This Website is owned and maintained by Pragathi Association for Rural Development (acronym PARD INDA). We recognize that visitors to our website may be concerned about the information they provide to us and how we treat that information. PARD INDIA is committed to protecting your privacy, and this Privacy Policy addresses all such concerns. This policy may be changed or updated from time to time. You should check this page from time to time to ensure that you are happy with any changes. This policy is effective from 1st October 2023.

If you have any questions about our Privacy Policy, you may contact us at:

Pragathi Association for Rural Development (PARD INDIA)

Ground Floor, Katari Kastle, Suryakantham Layout,

Goshala, Vepagunta Post,

Visakhapatnam, Andhra Pradesh. India, PIN: 530047.

Phone:(+91) 963-963-5858

Email: donorcare@pardindia.org

1. Personal Information

PARD INDIA uses its best efforts to respect the privacy of its online visitors. On our website, we do not collect personally identifiable information from individuals unless they provide it to us voluntarily and knowingly. This means we do not require you to register or provide information to us to view our website. PARD INDIA only gathers personally identifiable data, such as names, addresses, zip/postal codes, phone numbers, e-mails, etc., when voluntarily submitted by a visitor. For example, we ask for personal information on our online donation pages and use this information to acknowledge receipt of your donation for tax purposes.

PARD INDIA does not sell or trade such information collected to third parties. We will not share personally identifiable information with third parties unless authorized by the person submitting the information or required by law.

2. Credit Card Information Security

PARD INDIA uses industry-standard Secure Sockets Layer (SSL) encryptionto protect the security of your transaction and the confidentiality of your personal information. This makes it extremely difficult for anyone else to intercept the credit card information you send to us.Further, we use Razorpay Payment Gateway, which protects users’ data.

Credit card information is not sold or traded to third parties. We will not share credit card information with third parties unless required by law.

If you still have concerns about the security of your credit card information, contributions may also be made by calling (+91) 963-963-5858 or by sending personal bank Cheques or Demand Drafts to:

Pragathi Association for Rural Development (PARD INDIA)

Ground Floor, Katari Kastle, Suryakantham Layout,

Goshala, Vepagunta Post,

Visakhapatnam, Andhra Pradesh. India, PIN: 530047.

Phone:(+91) 963-963-5858

Email: donorcare@pardindia.org

3. Security

We are committed to ensuring that your information is secure. To prevent unauthorized access or disclosure, we have put in place suitable controls to safeguard and secure the information we collect online.

4. Donations

We request information from the visitor on our donation form. A visitor must provide contact information (such as name, e-mail, phone number, and mailing address) and payment information (such as credit card number and expiration date). This information is used for billing purposes and sending a donation receipt. If we have trouble processing a donation, the information is used by us to contact the visitor. Suppose the visitor has permitted the information's release; in that case, the visitor's name and contact information may be shared with carefully selected organizations and charities we feel our donors would want to know about. The credit card information of the Donors is NEVER released.

5. Opt-Out

If you supply us with your postal address or e-mail address online, you may receive periodic mailings from us with information on our programs and services. If you do not want to receive postal mail or e-mail from us in the future, please let us know by sending an email to us at info@pardindia.org or writing to us at the above address and telling us that you do not want to receive postal mail or e-mail from us. Some mailings are prepared well in advance, so please allow us three months for your request to be reflected on our mailing lists.

6. Cookies

Visitors should know PARD INDIA's website may automatically collect non-personal information and data through cookies. Cookies are small text files a website can use to recognize repeat visitors, facilitate the visitor's ongoing access to and use of the site, and allow a site to track usage behavior and compile aggregate data that will allow content improvements. Cookies are not programs that come onto visitors’ systems and damage files. Generally, cookies assign a unique number to the visitor without meaning outside the given site. Suppose a visitor does not want information collected through cookies; in that case, a simple procedure in most browsers allows the visitor to deny or accept the cookie feature. PARD INDIA uses cookie technology only to obtain non-personal information from its online visitors to improve visitors' online experience and facilitate their visitsto our site.

7. Sharing

Legal Disclaimer: Though we make a good-faith effort to preserve visitor privacy, we may need to disclose personal information when required by law wherein we have a good-faith belief that such action is necessary to comply with a current judicial proceeding, a court order or legal process served on our website.

8. Notification of Changes

If we decide to change our privacy policy, we will post those changes to this privacy statement. Hence, our visitors are always aware of what information we collect, how we use it, and under what circumstances we disclose it. We will use information in accordance with the privacy policy under which the information was collected.

If, however, we are going to use visitors' personally identifiable information in a manner significantly different from that stated at the time of collection, we will notify visitors via e-mail. We won’t disclose this information unless express information is granted. However, if visitors have opted out of all communication with the site, or deleted/deactivated their account, then they will not be contacted, nor will their personal information be used in any manner.

9. External Web Links

This website may contain links to other websites. Unless we expressly state otherwise, PARD INDIA makes no representations whatsoever concerning the content of those websites. The fact that PARD INDIA has provided a link to a site is not an endorsement, authorization, sponsorship, or affiliation concerning such site, its owners, or its providers. Risks are associated with using any information, software, or products found on the Internet. PARD INDIA cautions you to ensure you understand these risks before retrieving, using, relying upon, or purchasing anything via the Internet.

In addition, we encourage our users/donors to be aware when they leave our website to read the privacy statements of everyother website that collects personally identifiable information. These other websites may collect or solicit personal data or send their cookies to your computer. Please be aware that PARD INDIA is not responsible for the privacy practices of other websites. Please check the privacy statements of these other websites for more information about their policies on collecting and using personal data. This privacy statement applies solely to information collected by this website.

10. Referrals

If a visitor uses our referral service to inform a friend about our site, like spreading the word, we ask them for the friend's name and e-mail address. PARD INDIA will automatically send the friend a one-time e-mail with an introduction to PARD INDIA and an invitation to visit the site. The one-time e-mail will include the name of the person making the referral. PARD INDIA stores this information to send this one-time e-mail and track the success of our referral program. The friend may contact PARD INDIA at unsubscribe (info@pardindia.org) to request the removal of this information from our database.

11. Interactive Features

From time to time, our website requests information from visitors via interactive features, such as surveys, feedback, testimonials, or quizzes. Participation in these features is entirely voluntary, and the visitor, therefore, has a choice of whether to disclose this information. The requested information typically includes contact information (such as name, phone number, address, e-mail, etc.) and information on the visitor's interests. Survey information will be used to monitor or improve the use and satisfaction of this website and provide pertinent information to participants. Visitors' personally identifiable information is not shared with third parties.